Anyone who has contemplated the purchase of a fine stringed instrument knows that first and foremost they are an artist’s essential tool, partner and muse, but equally, when carefully considered, they can be a highly rewarding long term investment. Anecdotally, we are told that violins are good and safe investments, that prices go up, not down, but compared to other investment classes there exists very little academic research or published studies on this subject. Historically, this was due to limited access to sale and pricing data. But data aggregation and transparency are essential parts of the Tarisio-Cozio mission and we believe that access to accurate market data and pricing transparency is fueling the next generation of smart and informed instrument purchasers.

In 2015 I was contacted by Angela Ortiz Muñoz, a finance doctoral candidate at the University of Luxemburg, who was researching the historical investment returns of fine musical instruments. Over the next five years we supplied Dr. Ortiz Muñoz with unique access to Tarisio’s data of global auction results and private sales. As a result of her research, Dr. Ortiz Muñoz has published a highly relevant thesis on the violin market, a summary of which we present here. The results are encouraging and will confirm what investors have known for centuries: over the medium and long term, fine instruments make excellent investments.

– Jason Price

These are the main findings and conclusions from Dr. Angela Ortiz Muñoz’s doctoral thesis, defended last June at the Finance Department of the University of Luxembourg (LSF) together with SDA Bocconi, the Swiss Institute of Finance, and the Hoover Institution at Stanford University. The data provided by Tarisio was the main source of empirical information used for this research. The full version of this study can be obtained by request to cozio@tarisio.com.

INVESTIGATING THE POTENTIAL OF INVESTING IN FINE STRINGED INSTRUMENTS AS AN ALTERNATIVE INVESTMENT ASSET

By Dr. Angela Ortiz Muñoz

The first conclusion of my research is that fine stringed instruments offer a steady annual increase in real returns between 3.7-6.9%, with a dramatic increase in value since the 1980s. Over the past forty years, many instruments in the top tier have climbed in value, up to 12%, with little downside or volatility.

The thesis reviews public auction and private dealer markets for stringed instruments; it investigates the price dynamics of violins; and tackles some fundamental market-specific limitations in order to observe the true underlying returns that this asset class provides. Further, the thesis assesses the investment diversification potential of fine stringed instruments as well as the optimal portfolio allocation for investors interested in these assets.

An additional targeted research examines the ‘masterpiece effect’ within the violin market by using a repeated sales database of 337 observations to conclude that violins by Stradivari and Guarneri del Gesù should be unquestionably the most preferred and therefore offer the highest investment opportunity. A second targeted study explores the ‘musician effect’ and its influence on the price of violins. I observed that violins that have been played by celebrated musicians attract higher prices. By using event study to isolate the ‘musician effect’, it was shown that a musician’s instrument preference translates into a measurable price increase.

The Impact of Transaction Costs

Transaction costs should be reduced from the return for an accurate portfolio optimization model.

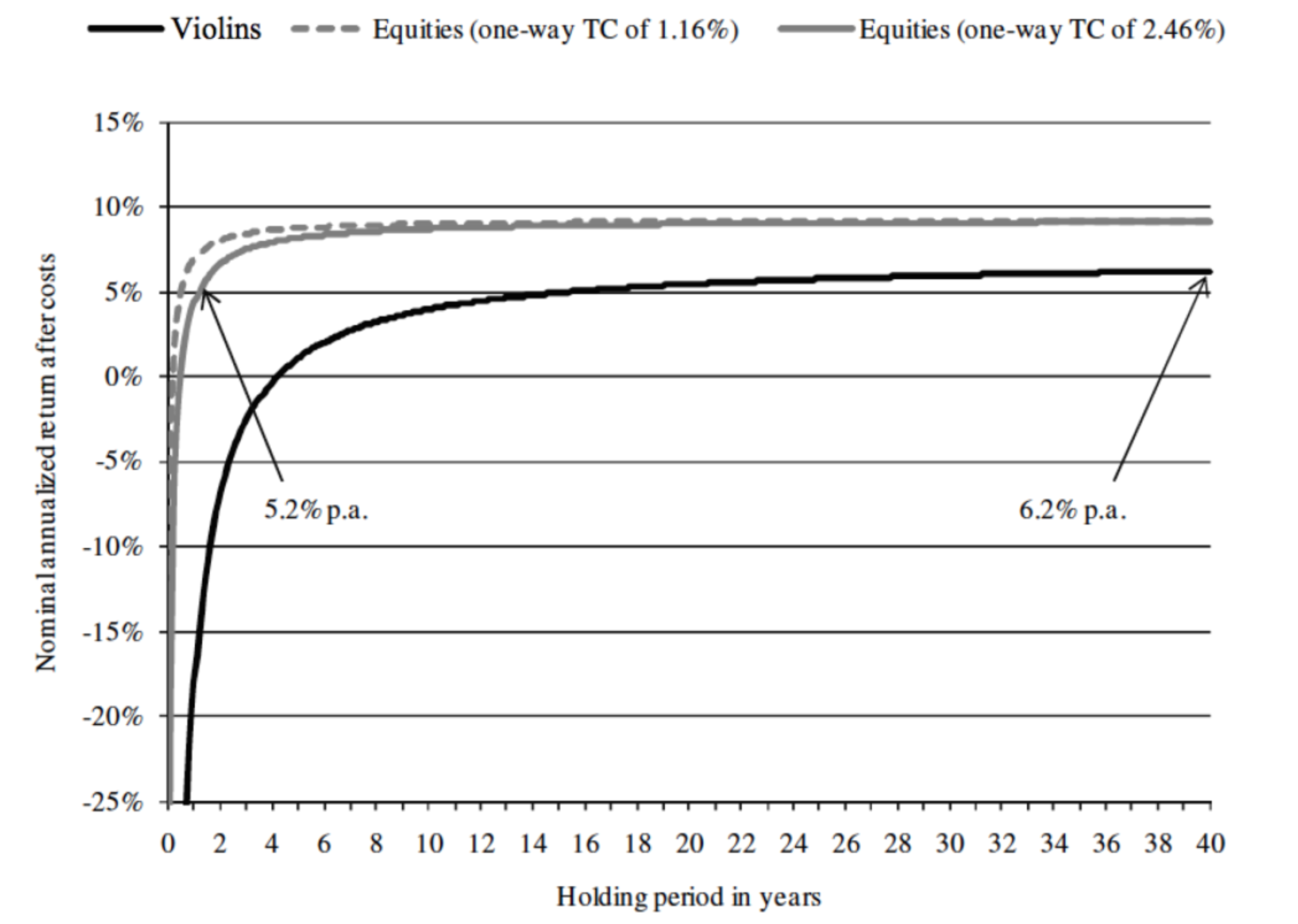

Figure 1: Annual post-cost returns on violins and equities

Figure 1: Annual post-cost returns on violins and equities

The above graph reveals that, as a historical average, a violin investor needs to hold on to his or her instrument for more than four years to expect a positive return. The analyzed data revealed that average holding times for instruments are 32 years, a period which is reduced to 19 years for top-tier instruments. With a forty-year holding period, the mean yearly return on top-tier violins’ net of transaction costs is 6.2%; after twenty-five years and ten years, the annualized after-cost returns are 5.8 % and 3.9 %, respectively. A long investment horizon is particularly necessary given that violins can also change in real value over many successive years.

In addition, when taking into account differences in holding periods and in transaction costs, I observed that the realized returns on violins and equities may be closer to each other than one might conclude at first sight. The transaction costs associated with buying and selling violins are significantly higher than those of an average trade of financial securities. However, if one takes into account the long average holding periods of violins on the one hand, and the high turnover in many financial portfolios on the other, the transaction cost drag associated with an average violin may actually be lower than that of many financial portfolios.

Portfolio Diversification

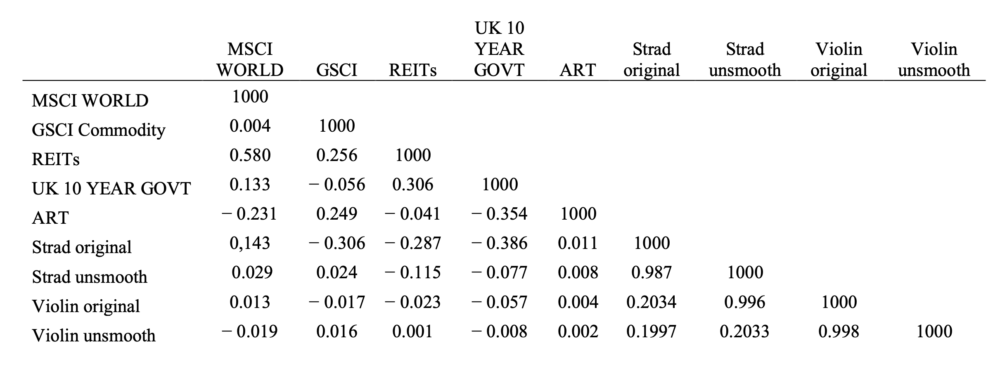

The risk-adjusted return for investments in violins is similar to that of art and superior to that of gold. The correlation between violins and other financial asset classes is significantly low. Violins are negatively correlated to bonds and real state, and positively correlated to commodities and art. This result hints as well at the existence of a wealth effect.

Table 1: Correlations between different asset classes

Table 1: Correlations between different asset classes

Sensitivity to the Equities Market

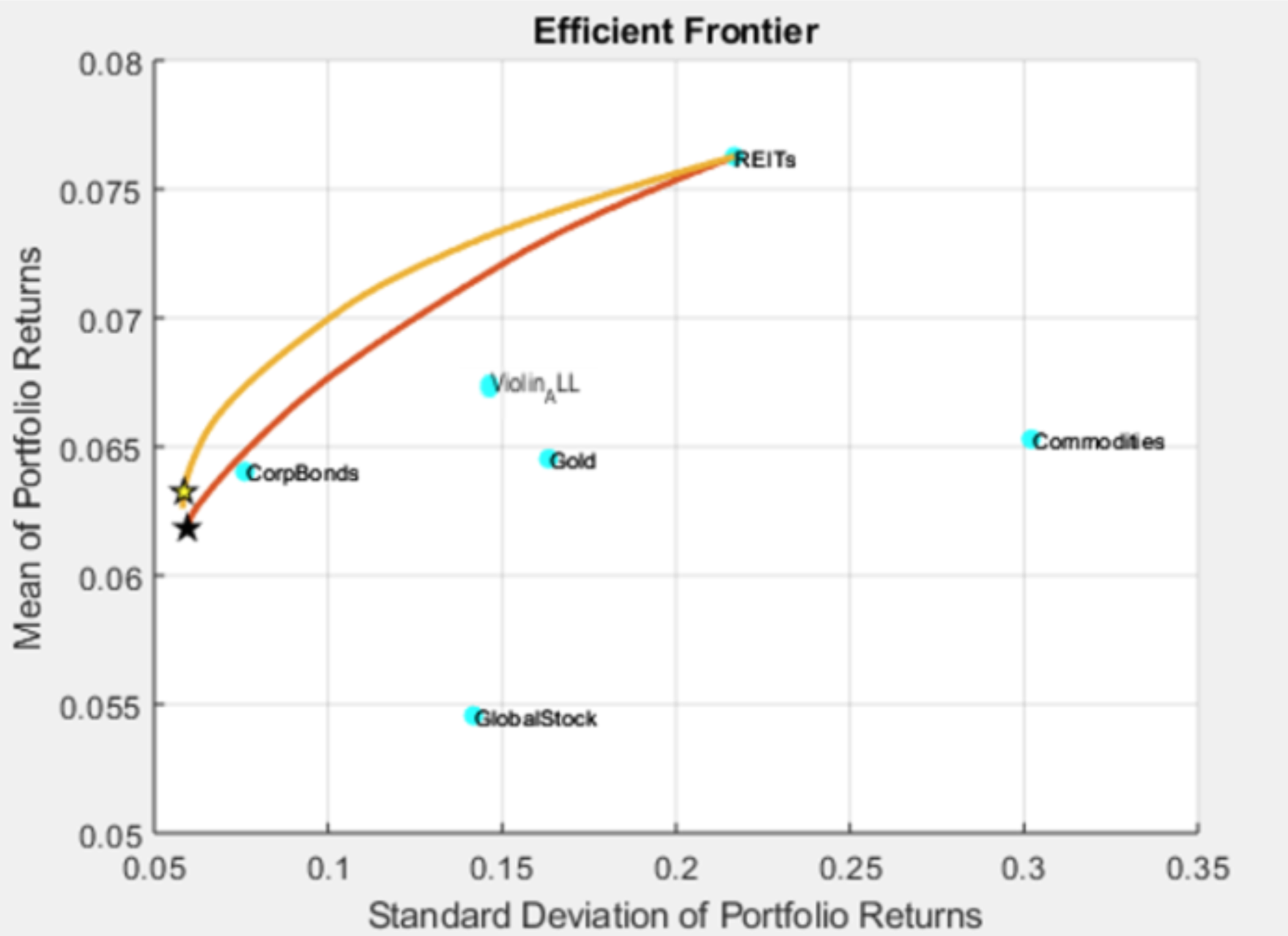

The Figure below shows the improvements of top violins after unsmoothing vis-à-vis the base portfolio mix. As illustrated by the figure, the inclusion of violins provides a significant diversification benefit to base portfolio mix by greatly increasing the efficient frontier. The yellow star stands for the optimal portfolio after the inclusion of fine instruments and the black star depicts the base portfolios.

Figure 2: Portfolio Efficient Frontiers

Figure 2: Portfolio Efficient Frontiers

This research concludes that, during the period analyzed, violins made by Stradivari provided the highest performance since the 1980s, with unsmoothed geometric annual return between 4.9 and 7.7%. The rest of the violins in the sample, however, provided what at first appeared to be a less favorable performance, but in fact stabilized in the long-run at around 3.5- 6.7% unsmoothed annual geometric mean return per year. The historical violin price indices indicate that investing in fine violins, particularly those by top makers, may provide a promising return potential in the long-run.

The study also demonstrated that violin investments offer a valid means of diversification. Including Stradivari into a diversified portfolio raises the Sharpe ratio by 12%, after unsmoothing, and improves the efficient frontier under CAPM assumption, from 1980 until today. It is reinforcing to note that the positive correlation observed in the few existing past studies is also found here. The low correlation between violins and other financial asset classes, including art, suggests that investing in violins is a smart strategy within a diversified portfolio. After unsmoothing the violin return series, the standard deviation of real returns is higher than that of bonds, and relatively close to equities. After accounting for non-synchronicity in the returns of violins and equities, I concluded that there is a positive correlation between real equity and violin returns, but that the beta of violins is still relatively low. Further, strong evidence is found that violins hedge well against expected inflation, and with weaker support, and that violins hedge against unanticipated inflation. In addition, when taking into account the differences in holding periods and in transaction costs, the realized returns on violins and equities may in fact be closer to each other than at first glance. Of course, the low turnover in collectibles may in part be endogenous: there can be little doubt that high round-trip costs curtail turnover. Positive returns seem to start after four years of a buy-and-hold strategy.

The ‘Masterpiece Effect’ and the ‘Musician Effect’

Within the empirical research focusing on the returns from alternative investments, an interesting phenomenon has been observed: the ‘masterpiece’ effect. Intuitively, if some artworks are indeed believed to be ‘masterpieces’— works of exceptional quality or renown—then, we might expect the returns from investing in such objects to uniformly outperform the general sample and market. However, James Pesando, Jianping Mei & Michael Moses and Ashenfelter & Graddy, among others, have found that masterpieces tend to underperform against the market and, in fact, provide lower cumulative returns than non-masterpieces.

This study analyzed the ‘masterpiece effect’ within the violin market to discern whether it is more rewarding to invest in one single instrument or in a variety of lower quality instruments with an equal overall value (Mei Moses, 2002).

Using the repeat-sales regression method to test the dataset sample of 259 violins, I observed that “masterpiece” violins have a higher rate of return than the others, a result which differs from the broadly-held assumptions presented in literature for alternative investments. Further, it was investigated whether the ‘masterpiece effect’ changes depending on the definition of a masterpiece: does one examine the reputation of the luthier or the market value of the object?

Musical instruments, especially fine old stringed instruments, should be regularly played in order to maintain their acoustic properties. The triangular relationship between violin, musician, and owner can play a significant role when determining the price and investment return of these instruments.

Regarding the second study exploring the so-called ‘musician’ effect, I can conclude that enjoyable asset classes such as violins include subjective price determinants that should be accounted for when analysing the investment opportunity of this asset class. In the case of fine stringed instruments such as violins, musician preference for one violin over another clearly has an impact on its price. The analysis carried out demonstrates that, regardless of past provenance or factors such as an investor’s wealth, a musician’s choice for a particular instrument significantly influences price. This influence increases in relation to a musician’s reputation. The “musician” effect is further amplified with regards to violins made by less renowned makers and which possess a low provenance track. When isolating the ‘musician effect’ using event study methodology, I observed that revisions done by musicians over violins (revisions defined as interest over renting and playing a violin by musicians) impacts significantly the price of the violin changing hands. It is also observed that this effect diminishes in the long run, especially, when there is a downgrade.

Finally, I observed a lower trading volume of violins downgraded while the trading volume rises in violins upgraded by talented musicians. These results are new to this market and add a new perspective to the existing literature.

The full version of this study can be obtained by request to cozio@tarisio.com.